Investors that trade on cryptocurrency exchanges generally know that, in order for the platform to work, there need to be buyers and sellers. Both parties come together to trade their cryptocurrencies, for the hopes of making profit. The total amount of money in those transactions is known as the volume on an exchange. The higher the daily volume, the more popular a platform is. It may make you SMH, but you can check chatter on Twitter or Tiktok to confirm.

Since the development of crypto-tracking tools, investors trust the daily volume of exchange to determine:

- The quality of an exchange platform

- The highest potential for a new coin’s growth after its listing

- The speed with which they can exchange their crypto such as Bitcoin or Tezos

In time, however, experienced traders started to notice something unusual. The top-ranking exchanges were not at all popular. In some cases, no one had ever heard of them – OMG! This can produce some NSFW reactions along with plenty of videos in 4K HDR on Youtube discussing the topic and issues.

For many new investors, choosing an exchange became quite confusing. How is it possible that a platform, which makes tens of millions of daily volume, has only 400 Twitter followers? How can it be that their Telegram group is dead silent?

Something was simply not right. And while it was clearly visible for experienced traders, it became a challenge to understand what was causing the issue.

Thankfully, Bitwise Asset Management decided to explore the topic in depth, analysing the methods with which daily volumes are reported. A 104-page document later, their findings shocked the crypto community.

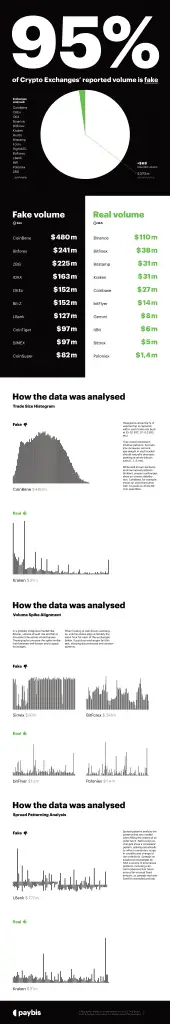

95% of crypto volumes are fake

According to the findings of Bitwise’s report, a large number of cryptocurrency exchanges reported artificially inflated volumes. Upon closer inspection, the numbers indicate that approximately 95% of the total volume is fake – and this includes reporting from major cities like Boston and New York but across nations and continents as well such as Canada, Australia, Thailand, Peru, Japan, China, Russia, and Mexico. .

Why does this occur? Bitwise argues that exchanges artificially inflate their volume to profit from more expensive coin listings, as well as gain high rankings in platforms like CoinMarketCap. As a result, newcomers feel somewhat confused when it comes to choosing an exchange to trade on.

So what did the report have to say about exchanges that actually present real volumes? Are there any platforms that can be trusted?

Paybis decided to illustrate the findings into a helpful infographic. It will give you a better idea of the platforms that report real volumes. Let’s have a look at a quick summary of the findings.

Many crypto enthusiasts got angry at the news. Some called it FUD, others saw it as a cheap effort to disgrace the potential of Bitcoin. Only few understood how these findings were actually a great thing for the crypto space. Maybe some just lamented about HIFW they got REKT with an ICO gone south.

The community demanded answers from CoinMarketCap. The company looked into the issue and confirmed the findings of Bitwise. As a result, the popular crypto market tracker introduced a new metric, which helped users better filter exchanges. The Liquidity metric was built to help traders and investors explore the liquidity of exchange platforms.

After CMC’s recent acquisition by Binance, the outdated metrics were also massively improved. Currently, the reported volumes present truthful information, and users are able to differentiate trustworthy from “scammy” exchanges.

What is next?

The cryptocurrency market is still very undervalued. The good news is that, as the space grows, the metrics of data collection improve as well. Therefore, exchange platforms are headed towards a more accurate and transparent representation of their volumes TBH.

Adding to that, Binance is actively trying to acquire different exchange platforms, and we are early in the industry lifecycle just like with cannabis and products like CBD Gummies. Their goal is to create as many new FIAT on-ramps as possible. This effort will only multiply in the coming months. In time, the requirements for the proper operation of exchange platforms will drastically change to favour their users.

All in all, the crypto market has shifted from an experiment to a pulsating investment opportunity. And with companies like Bitwise and Binance increasing worldwide awareness, we are excited to see what the next 2-5 years will bring.

Check out other exciting crypto things as well such as Lolli and the ability to earn Bitcoin when you buy normal stuff online.