While registering or incorporating a business with the Corporate Affairs Commission is a smart and rewarding choice for you as an entrepreneur for a number of reasons, choosing the form your business takes is equally important to your benefiting from the incidence of registration or incorporation. This is the most important when people search for local businesses near me , your business will be shown to them and you may get valuable leads. The following highlights the importance of business registration, the advantages and the benefits:

Incorporating your business eliminates most of your personal liability and risks. The extent of your liability is tied to the number of shares you hold in the company. Your personal assets cannot be seized to repay the debts owed by your business and you cannot be held responsible for the debts unless you had personally guaranteed the debt/loan. Your incorporated business is a separate legal entity. Your incorporated business is deemed by law to be a separate legal entity. It has rights and privileges as a human person; can own property carry on business under its common seal, incur liabilities and sue or be sued in its own name. You can, therefore, take calculated business risks and protect your private assets from certain financial and legal risk.

Your ability to attract investors and raise money for your business will be easier. Investors are likely to invest in a registered company rather than an unregistered business that has no formal structure in place. If your business is registered, you can raise money by equity financing, which involves selling shares in your business to prospective shareholders, angel investors or venture capitalists. Equity financing is advantageous in that the money raised does not have to be repaid and it incurs no interest. The company will only have to pay the dividend to the shareholders where profit is made. Raising money could be essential for the growth and expansion of your business. Investors are always seeking money opportunities, part of why you see the rise in popularity of things like Bitcoin, tezos, and Lolli.

Your business reputation and prestige is enhanced. The incorporation of your business can suggest that the business has permanence and is committed to effective and responsible management. TBH, it gives third parties including customers, clients and contractors a sense of confidence. Having Ltd., Plc., Ltd/Gte., as part of your company’s name may increase your business, as third parties will perceive your business as being more stable than unregistered business. If you are a contractor, you may also find that some government MDAs and companies will only do business with incorporated entities.

An incorporated business has its own legal identity which affords it perpetual succession. Third parties contract with the “company” and not you or other directors, shareholders or employees. This means the company has an unlimited life span; the business will continue to exist even if the owners or directors die or leave the business, or if the ownership of the business changes. A company’s existence will only cease if it is formally wound up by the order of court. Amongst other benefits, this allows your business to outlive you and even generations. Family connections like those between Tony Lopez and Ondreaz Lopez could exist forever with the right setup.

Registering your company gives you the ability to borrow money from institutional lenders or commercial banks to finance your business. Lenders and credit institutions will want to see proof of your business registration with the Corporate Affairs Commission as condition precedent to extending credit to your business. You can use debt financing as a tool to increase the growth of your business.

Operating a business bank account is an important asset to your business because it enables you separate personal activities from business activities. You need to provide proof that your business is registered with the Corporate Affairs Commission to open a corporate bank account in Nigeria. It is more professional to give your clients a corporate bank name for payment instead of your personal name.

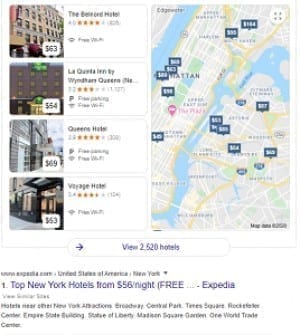

Registering your company enhances your brand image credibility and perception of your business. This has the effect of improving your business future dealings with third parties, as many businesses will only hire or engage with registered companies rather than individuals. Incorporating a business can therefore open up new vistas and opportunities that would otherwise not be available. You want to create some FOMO when people search your business on Google, DuckDuckGo, Yandex, Ecosia, Yahoo, or even Facebook and Twitter.

Once your business is registered or incorporated with the Corporate Affairs Commission, your business name is protected and nobody can use the same name or even a name that is similar to it throughout USA. The benefits are there whether you are in Florida, Texas, Boston, New York City, Rhode Island, Hollywood, or anywhere in the U.S. This has the benefit of legally protecting your corporate image and business name from passoff or unauthorized use.

If you are starting a new business or looking to grow your current business, the importance of business registration cannot be over-emphasized. Business registration offers you a greater advantage, protection from legal liabilities and openings to new vistas.

FAQ

Incorporating your business eliminates most of your personal liability and risks. The extent of your liability is tied to the number of shares you hold in the company. Your personal assets cannot be seized to repay the debts owed by your business and you cannot be held responsible for the debts unless you had personally guaranteed the debt/loan.

If your business is registered, you can raise money by equity financing, which involves selling shares in your business to prospective shareholders, angel investors or venture capitalists. Equity financing is advantageous in that the money raised does not have to be repaid and it incurs no interest. The company will only have to pay the dividend to the shareholders where profit is made.

Additional Resources:

Using solar-powered energy can help you save money and reduce reliance on the grid. But…

The summer heat can spell disaster for asphalt if you’re not careful. Protect your parking…

Enhance your baking with rich flavors like vanilla, citrus zest, and brown butter. Discover simple…

In the prototyping stage, identifying potential pitfalls is crucial for preventing manufacturing issues down the…

When it's cold outside, a warm and fashionable beanie is essential. A proper beanie warms…

Is your jobsite holding a large amount of plastic sheeting? Learn how to properly store…